There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

The Hidden Problem

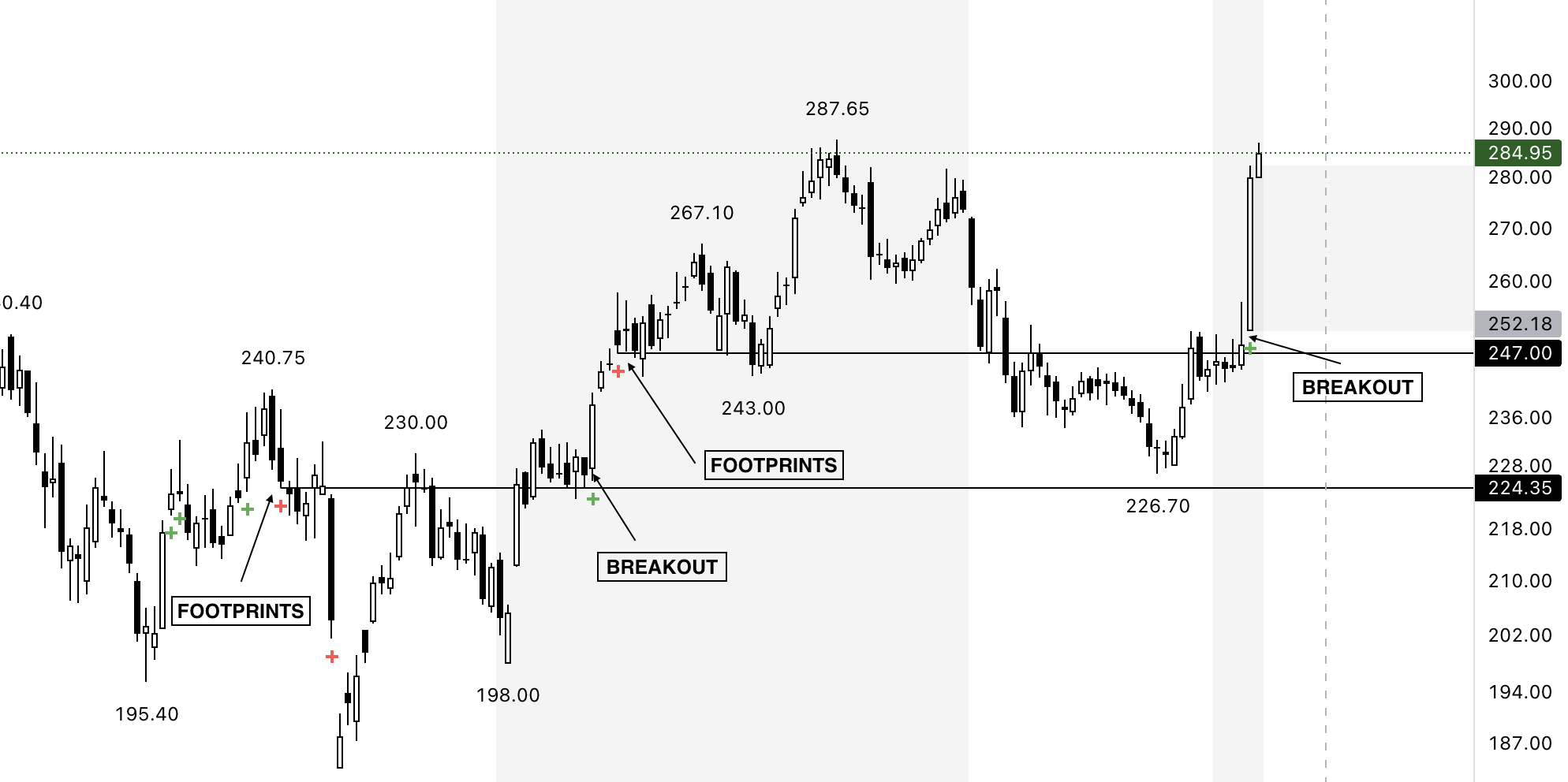

Volume is called the “footprint of money.” Yet for many traders, it’s just a colored bar at the bottom of a chart. They assume a big green bar means “buying” and a big red bar means “selling.” But markets don’t work that way. Big players disguise their activity. What appears to be strong buying can actually be distribution, and what looks quiet can be stealth accumulation. This is why retail traders often chase moves too late — and get trapped. If you’ve ever wondered why you buy a breakout and it fails, or why stocks run up when volume looks ordinary, you’re not alone. The problem isn’t you — it’s how most traders look at volume.

Most traders assume that high volume is always bullish. That’s a costly mistake.

Instead of glancing at volume bars in isolation, you need context.

Relative volume:

Is today’s bar truly exceptional compared to the last few weeks or months? A “big” bar on a quiet stock might still be irrelevant.

Price reaction to volume:

Strong volume is only meaningful if price holds or advances. If price gives back gains immediately, that volume likely represents distribution, not accumulation.

Location matters:

Volume at support or resistance carries far more meaning than volume in the middle of nowhere. Smart money steps in at clear levels, not randomly.

When you shift focus from “Is volume high?” to “What does price do with this volume?”, you stop reacting emotionally and start thinking like a professional.

Misreading volume isn’t just an academic problem — it’s expensive.

Manually tracking “very important” candles is tedious. You’d have to check every bar, compare it to history, and decide whether it matters — all while markets are moving. Miss just one key candle, and you miss the move. That’s why we built VIV (Very Important Volume) — to do the heavy lifting for you:

Manually tracking “very important” candles is tedious. You’d have to check every bar, compare it to history, and decide whether it matters — all while markets are moving. Miss just one key candle, and you miss the move. That’s why we built VIV (Very Important Volume) — to do the heavy lifting for you:

Volume isn’t a buy or sell signal by itself — it’s part of a bigger conversation between price and participation. Traders who learn to read this conversation stop chasing noise and start following genuine strength.

Whether you use your own methods or tools like VIV, the goal is the same:

Spot the market’s real footprints early, before the crowd reacts.

If you’ve been frustrated by false breakouts, sudden reversals, or confusing volume spikes, it’s not because you’re bad at trading. It’s because you’re trying to read a story without knowing which pages matter.

VIV simply highlights those pages for you — leaving you free to focus on the bigger picture.