There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

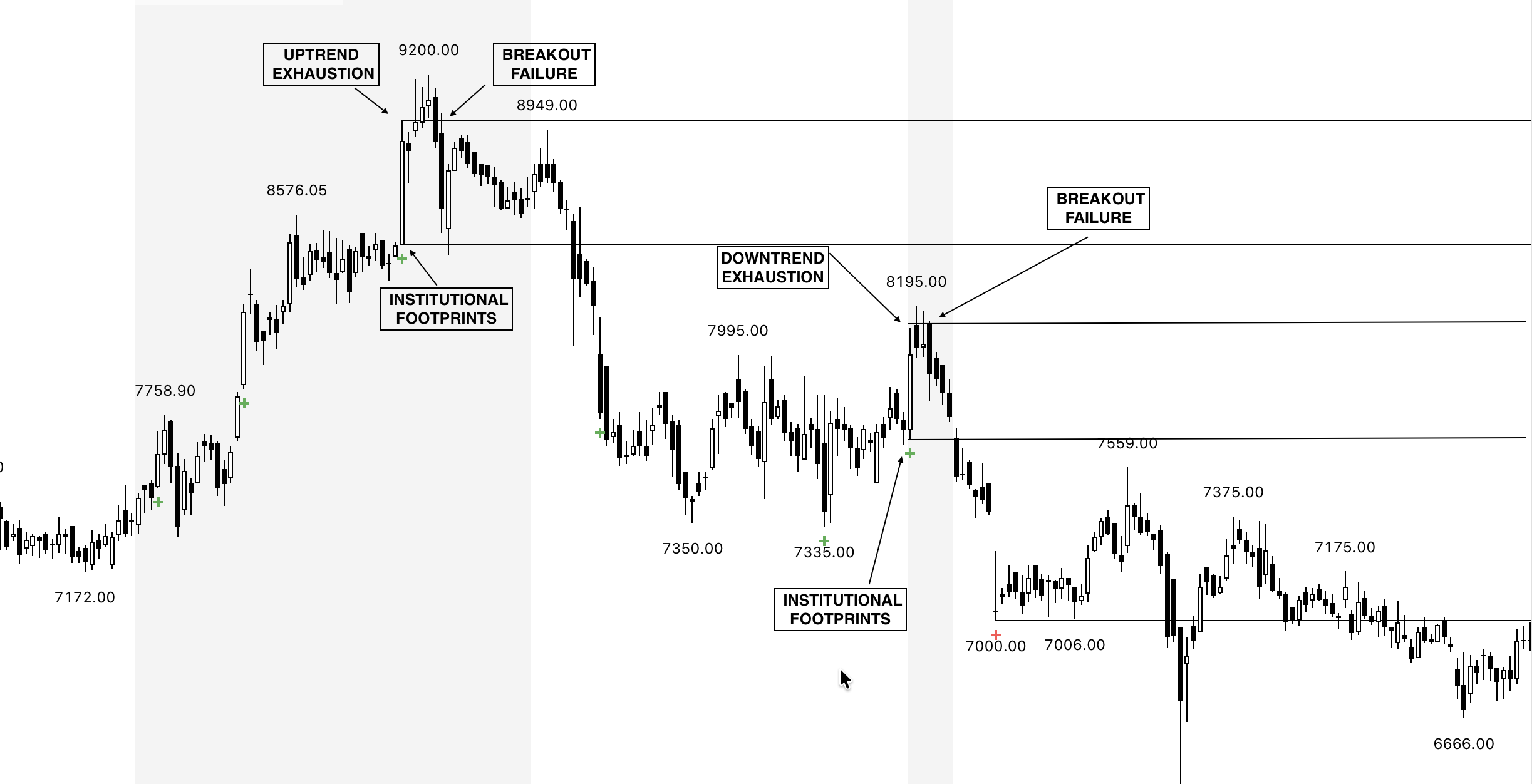

Every trend, no matter how strong, eventually runs out of fuel. The problem is that most traders can’t recognize the signs until it’s too late. They enter when the move is already stretched, only to see price reverse sharply.

This is where the concept of volume exhaustion becomes crucial. Volume doesn’t lie — it reflects real market participation. When a trend nears its end, volume often reveals the hidden footprints of smart money quietly exiting while latecomers rush in.

In this blog, we’ll break down what volume exhaustion is, why it matters, how to detect it, and how the VIV Indicator makes this process effortless.

Volume exhaustion occurs when a price move is accompanied by unusually high volume that fails to push the trend further. Instead of supporting continuation, the surge in activity signals climax behavior — often the last burst before reversal. For example:

While not always easy, here are common clues:

The VIV (Very Important Volume) Indicator automates this process by:

Volume exhaustion is the final chapter of a trend’s story — but only traders who know how to read it can avoid getting trapped at the end. By learning to recognize exhaustion signals, you protect your capital and prepare for new opportunities.

The VIV Indicator takes the guesswork out of this process. It automatically highlights exhaustion zones, draws important levels, and helps you see where smart money is stepping away.

In trading, timing is everything. Don’t be the last to enter when the move is already over — let volume, and VIV, guide your decisions.