There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

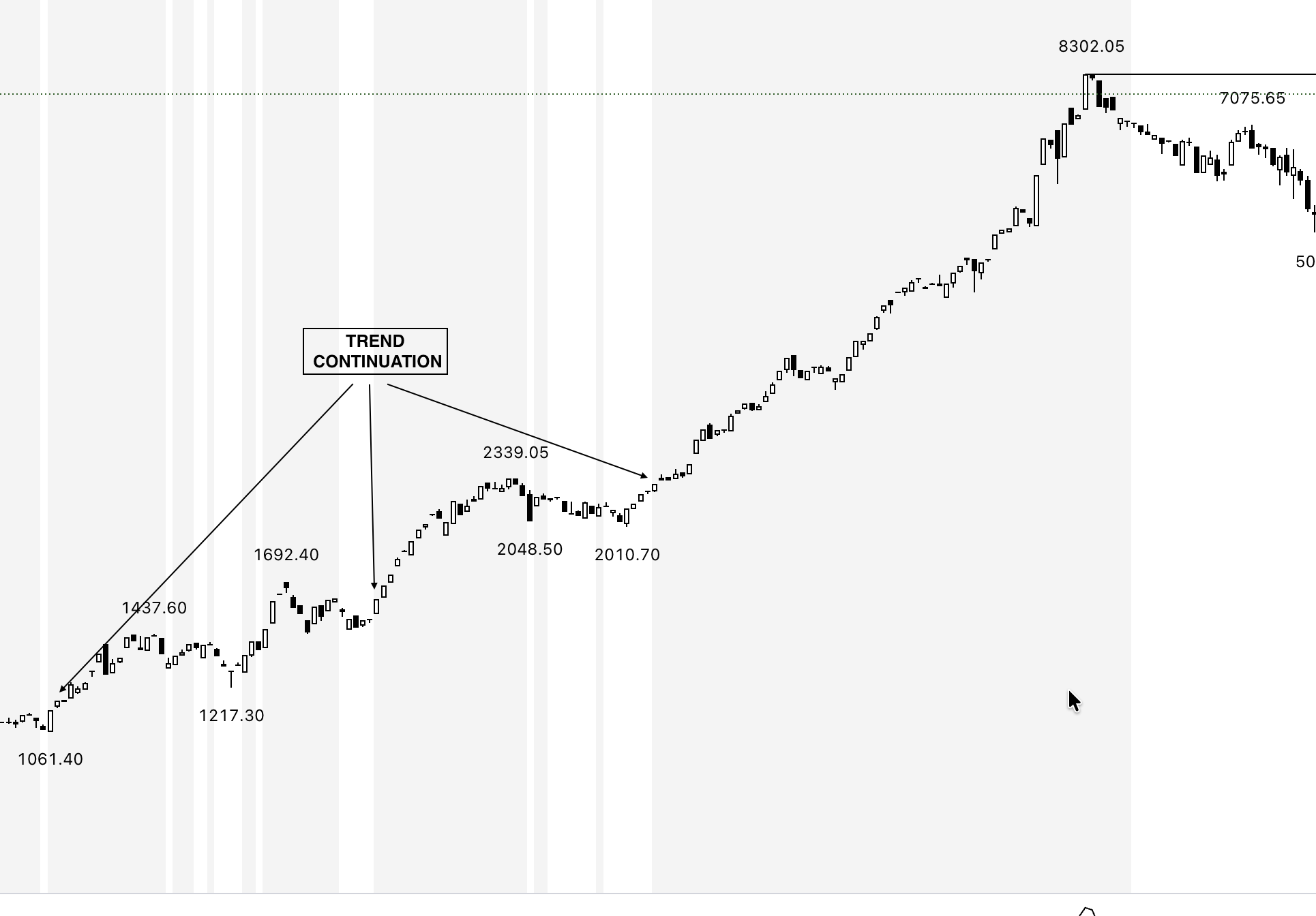

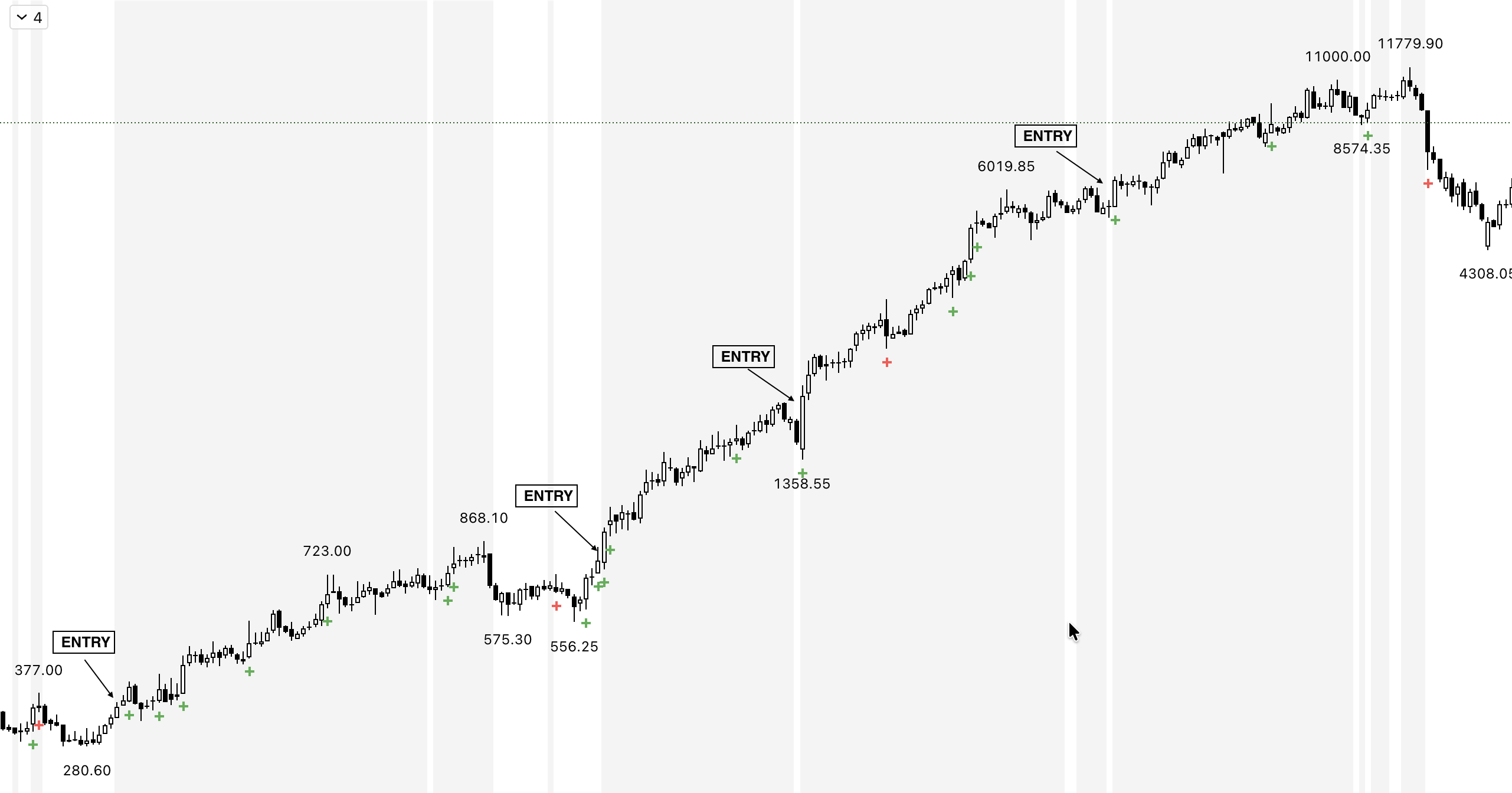

Most traders dream of catching tops and bottoms, but professionals know the real money lies in the middle of the move — the clean stretch where price trends smoothly with minimal noise.

That center portion of the trend is where conviction is highest, risk is manageable, and continuation patterns reveal themselves clearly.

But to ride this powerful middle phase, you must understand the anatomy of trend continuation — what it looks like, how it behaves, and why it forms. This article will teach you to recognize continuation with clarity so you’re not entering too late or exiting too early.

Trend continuation is the phase where price pauses, refreshes, and resumes in the same direction.

It’s not a reversal, not a top, and not exhaustion — but the healthy breathing pattern of a trending market. Continuation phases show up as:

Continuation phases reflect balanced behavior between buyers and sellers.

Here’s the sequence:

Many traders mistake pullbacks for reversals.

Here’s how to avoid that trap:

1. Depth of Pullback

The trend may be strong, but continuation setups are not frequent. They are selective — and waiting for them separates professionals from impulsive traders. Impatient traders:

Trend continuation is the heart of profitable trading. It’s where the market offers the best blend of momentum, structure, and risk control. When you learn to recognize continuation patterns — the pauses, the consolidations, the retests — you begin trading with the market, not against it.

Real growth happens not at the extremes but within the calm, steady middle of a trend. Master that, and you stop chasing markets — you start flowing with them.