There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

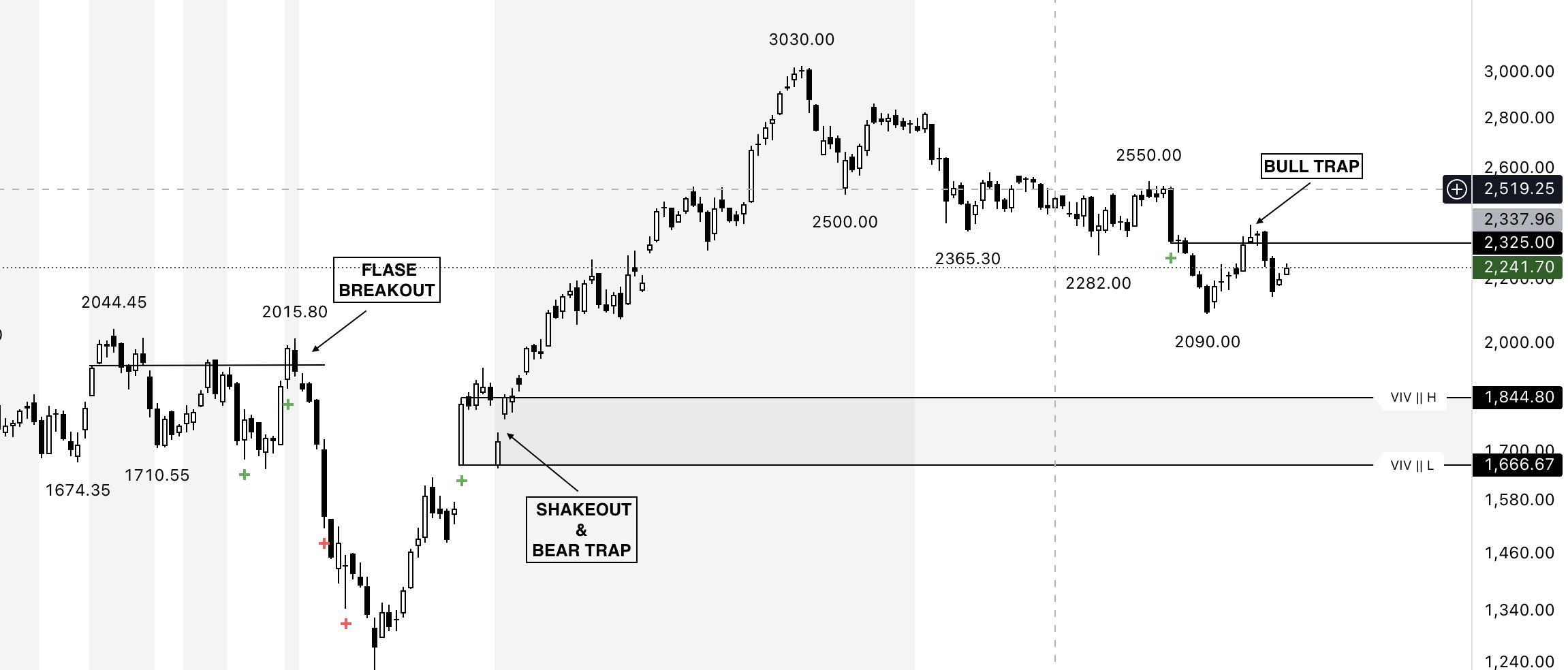

If trading was only about price going up or down, everyone would make money.

But the reality is that markets are designed to test, trap, and confuse traders—especially retail participants. Behind most sudden reversals, false breakouts, and unexpected stop-loss hits lies the invisible hand of smart money. These institutional players use traps to accumulate or distribute positions without revealing their true intent. In this blog, we’ll uncover:

A smart money trap is a deliberate move by institutions to mislead traders into taking the wrong side of the market.

Institutions manage large orders. They can’t buy or sell millions of shares in one go without moving the market. So they:

The difference between a genuine breakout and a trap often comes down to volume footprints:

The Very Important Volume (VIV) indicator highlights exactly where institutions leave their footprints.

The Very Important Volume (VIV) indicator highlights exactly where institutions leave their footprints.

When a breakout aligns with institutional footprints highlighted by VIV, you know the move is backed by real demand. When it doesn’t, you know a trap may be forming.

When a breakout aligns with institutional footprints highlighted by VIV, you know the move is backed by real demand. When it doesn’t, you know a trap may be forming.Smart money traps are not accidents—they’re part of how markets operate.