There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

One of the biggest regrets traders carry is not losses — it’s missed opportunities. You watch a stock break out, hesitate for a moment, and then see it run without you. The feeling that follows is painful:

“I missed it.”Most traders believe that once a move starts, the opportunity is gone.

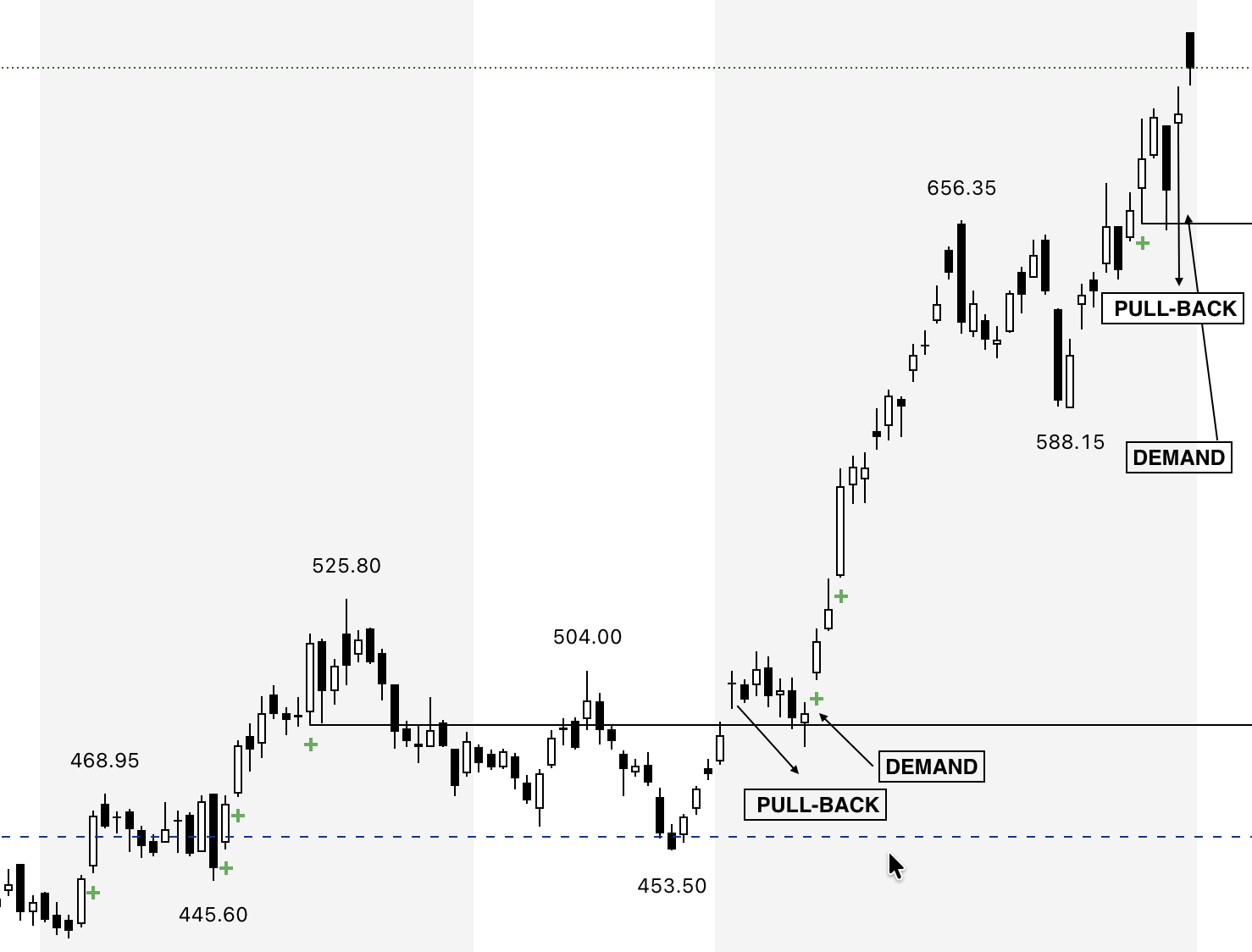

Markets don’t move in straight lines.

They move through cycles of expansion and contraction. After every impulse move:

Retail traders usually miss entries for three reasons:

A healthy pullback is the market asking a question:

“Are you willing to buy when excitement disappears?”Pullbacks exist to:

1. Structure Remains Intact Higher highs and higher lows in uptrends

Lower highs and lower lows in downtrends If structure holds, the trend is alive.

“Sellers tried — and failed.”

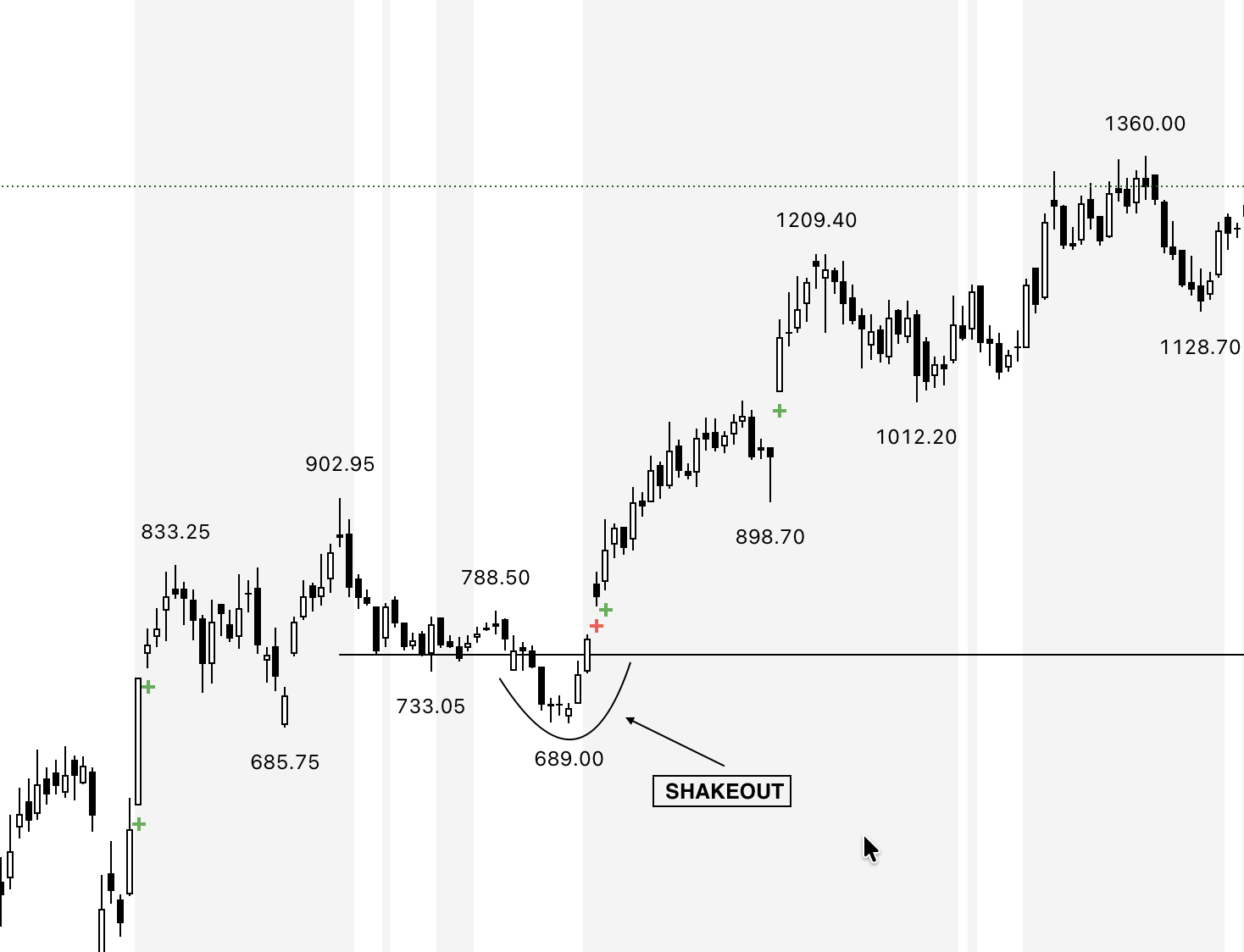

Markets intentionally create discomfort.

Markets intentionally create discomfort.

Pullbacks:

Ironically, re-entries are often:

❌ Chasing price after pullback ends

❌ Entering before pullback completes

❌ Ignoring structure breaks

❌ Assuming every pullback is a reversal Second chances reward patience — not prediction.

They don’t ask:

“Will this go up again?”They ask:

“Has the reason for the trend changed?”If the answer is no, the trend deserves another entry.

This is where trading becomes personal. You must accept:

Markets are generous — but only to those who respect their rhythm. Strong trends do not punish hesitation forever.

They offer pullbacks, pauses, and re-entries — again and again. The second chance market exists so disciplined traders can participate without emotion, without rush, and without regret. If you missed the first move, don’t chase.

Wait.

Because in strong trends,

The best trades often begin where patience replaces excitement.