There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

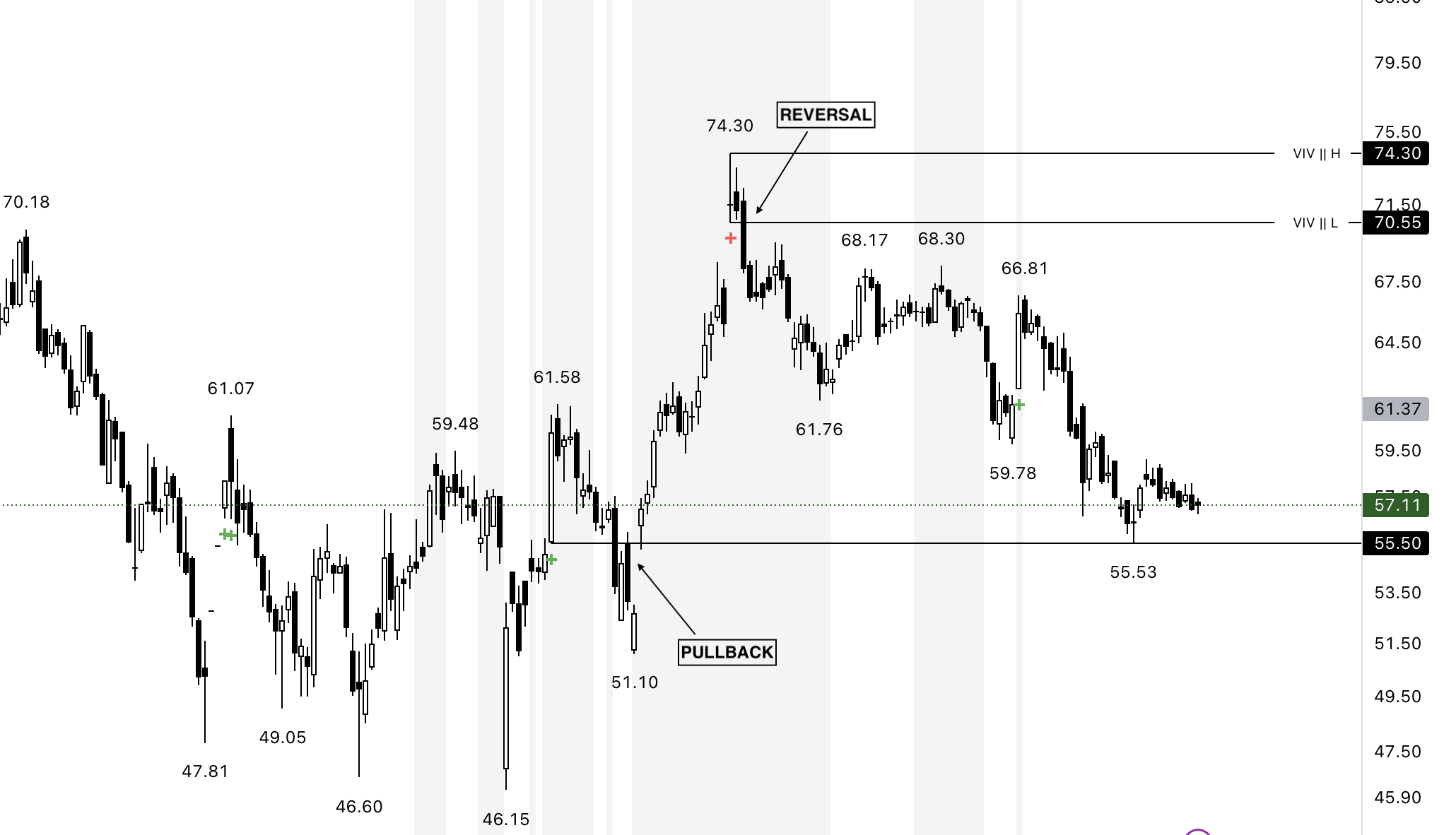

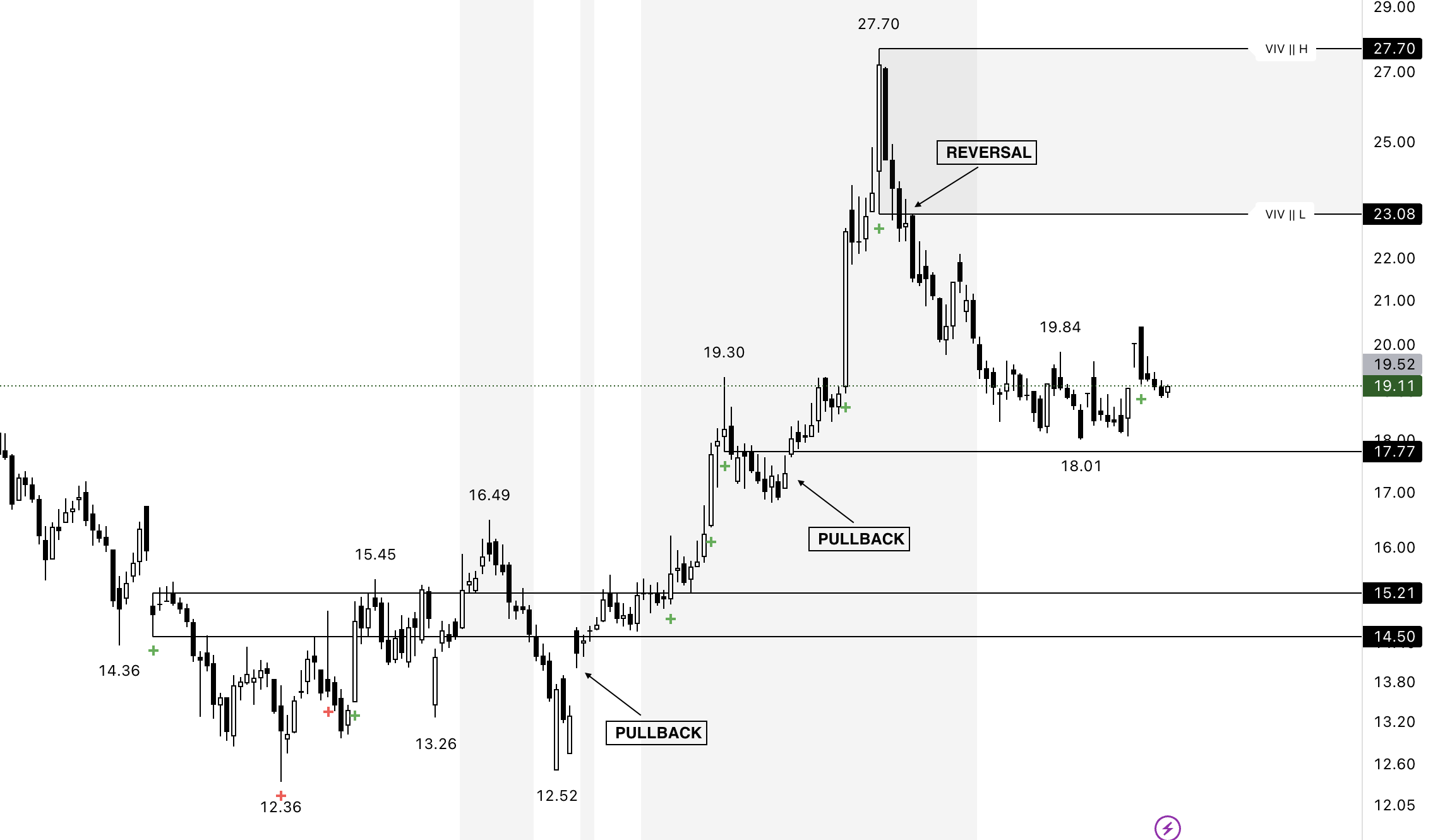

One of the most common challenges traders face is distinguishing between a pullback and a reversal.

At first glance, both look similar—a price that has been moving in one direction suddenly changes course. But beneath the surface, they tell very different stories. Get this wrong, and you’ll end up cutting winners too early or holding on to losers for too long. Get it right, and you’ll be trading with the confidence of professionals who understand how market trends actually unfold. In this blog, we’ll break down:

A pullback is a temporary pause or dip in the market, occurring within an established trend. Think of it as the market catching its breath before continuing the journey. Characteristics of pullbacks:

A reversal, on the other hand, signals a genuine change in the overall trend direction. Characteristics of reversals:

Pullbacks and reversals often look the same in the early stages. This is where most retail traders fall into traps:

Price alone isn’t enough to distinguish between pullbacks and reversals. The real story is told by volume footprints:

This is where the Very Important Volume (VIV) indicator comes in. While most traders only see price, VIV automatically highlights important volume footprints e.g. 52-week and lifetime high volume or combination of last many days or weeks, showing you where institutional money is active.

This is where the Very Important Volume (VIV) indicator comes in. While most traders only see price, VIV automatically highlights important volume footprints e.g. 52-week and lifetime high volume or combination of last many days or weeks, showing you where institutional money is active.

The difference between a pullback and a reversal can define your trading destiny.