There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

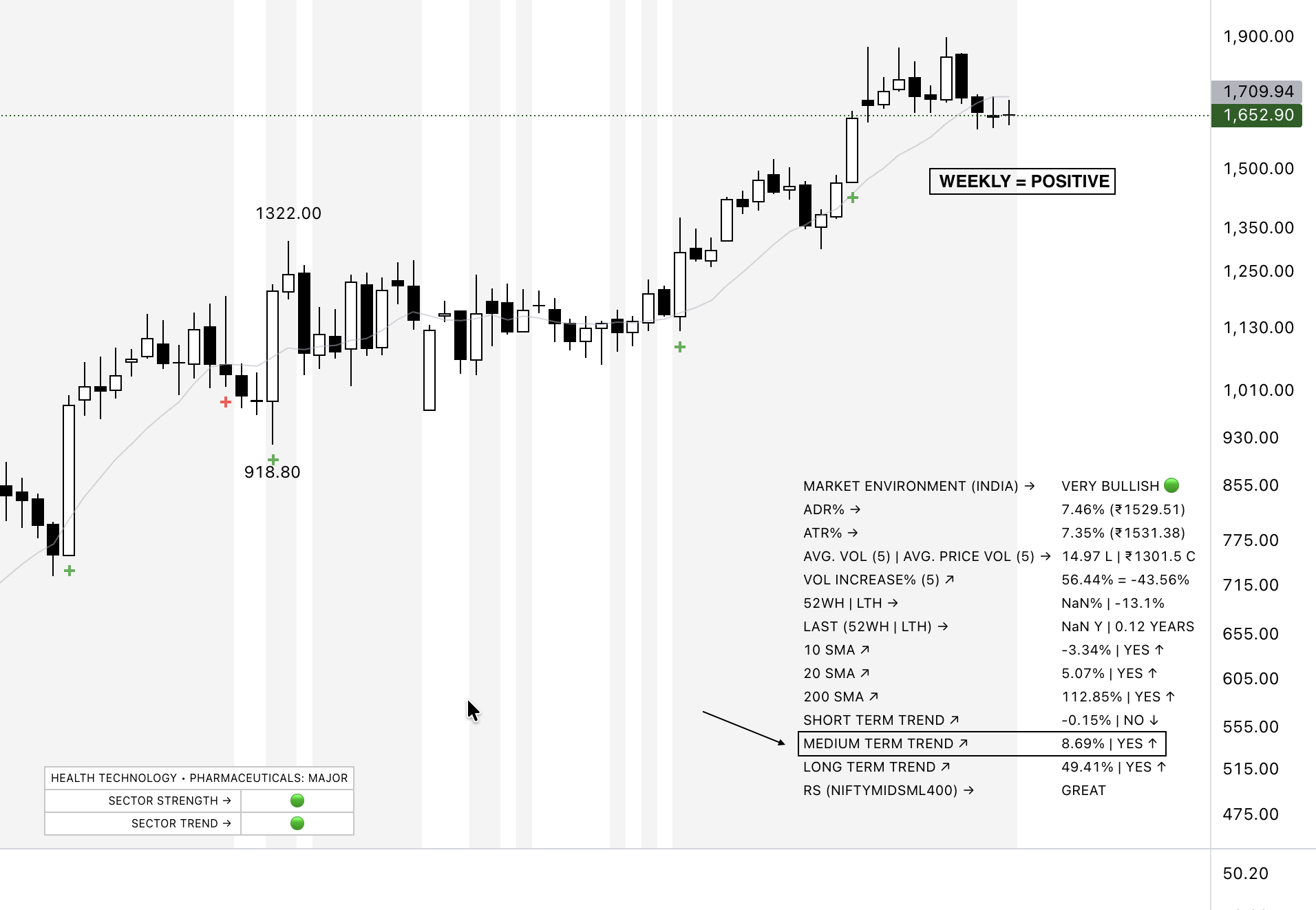

Every chart tells a story — but never the complete story.

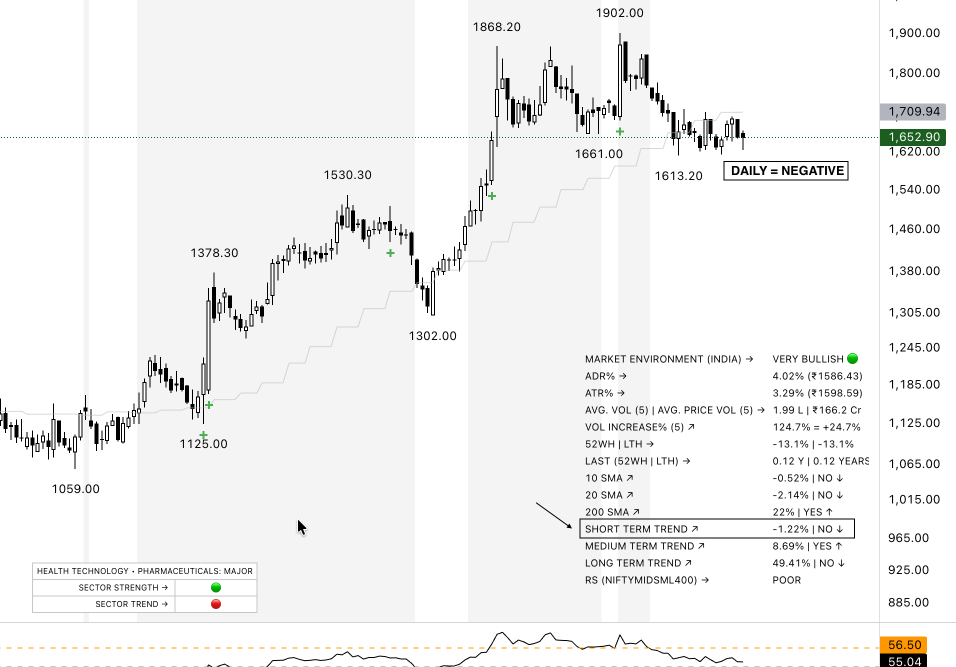

What looks like a breakout on the daily chart might be a simple pullback on the weekly. What appears as weakness on the hourly may be nothing more than noise inside a strong uptrend.

Traders who analyze only a single timeframe often trade blindfolded.

But traders who understand multi-timeframe storytelling see the full narrative — the long-term trend, the medium-term structure, and the short-term execution window.

Mastering this concept is not about complexity. It’s about clarity. It shifts you from reacting to candles to understanding context.

The market operates across different time horizons because participants operate across different time horizons:

1. Higher Timeframe (HTF): The Storyline This is where the real truth lies.

The weekly or monthly chart shows the overall direction, institutional positioning, and the big-picture structure. Here you identify:

Many false breakouts happen because traders only look at one timeframe.

Here’s how conflict deceives traders:

The best trades come when:

Here’s a simple, repeatable routine:

Step 1: Start With HTF (Weekly) Ask:

Most traders rush into setups because they look “ready.”

But professionals know that setups are only as strong as the timeframe supporting them. Multi-timeframe reading builds:

Price action is a language — and multi-timeframe analysis is how you understand the full sentence, not just a word. When you learn to read trends across timeframes, the market becomes coherent. Pullbacks make sense, breakouts become predictable, and traps reveal themselves before they form.

Remember:

The market speaks differently on each timeframe.

Your edge comes from understanding the entire story, not a single chapter.

Trade with context. Trade with clarity. Trade with the full picture.