There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

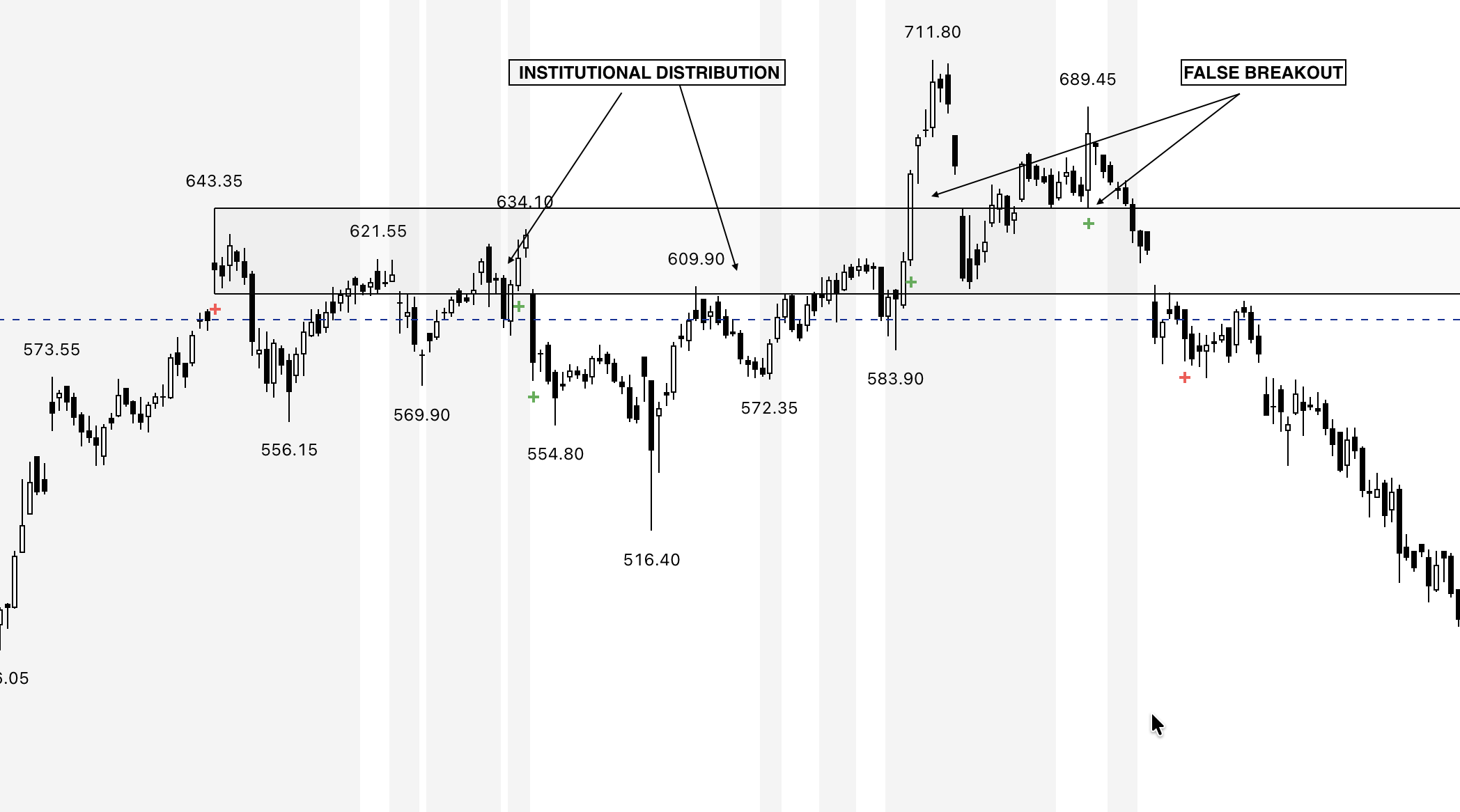

Every major market decline begins long before the charts make it obvious.

Retail traders see a strong rally and assume the trend will continue, but institutions have already started exiting quietly.

This silent exit — known as institutional distribution — is where smart money sells into strength while the crowd keeps buying.

Understanding distribution isn’t about prediction; it’s about awareness.

If you can read when institutions are unloading, you can protect your gains — or even profit from the reversal that follows.

Institutional distribution is the phase where large funds and professional traders begin reducing their holdings near market tops.

They can’t sell everything at once — doing so would crash the market. So instead, they sell slowly, across days or weeks, during periods of high optimism and strong volume. To the untrained eye, this still looks bullish. But under the surface, the smart money is exiting while retail is entering.

Here’s what typically happens during distribution:

Retail traders interpret high volume near highs as confirmation of strength — not a warning.

They chase breakouts, add to positions, and celebrate new highs while institutions quietly offload.

By the time price breaks support, it’s too late — the exit door is crowded. The market doesn’t crash out of panic; it declines because big players stopped buying weeks ago.

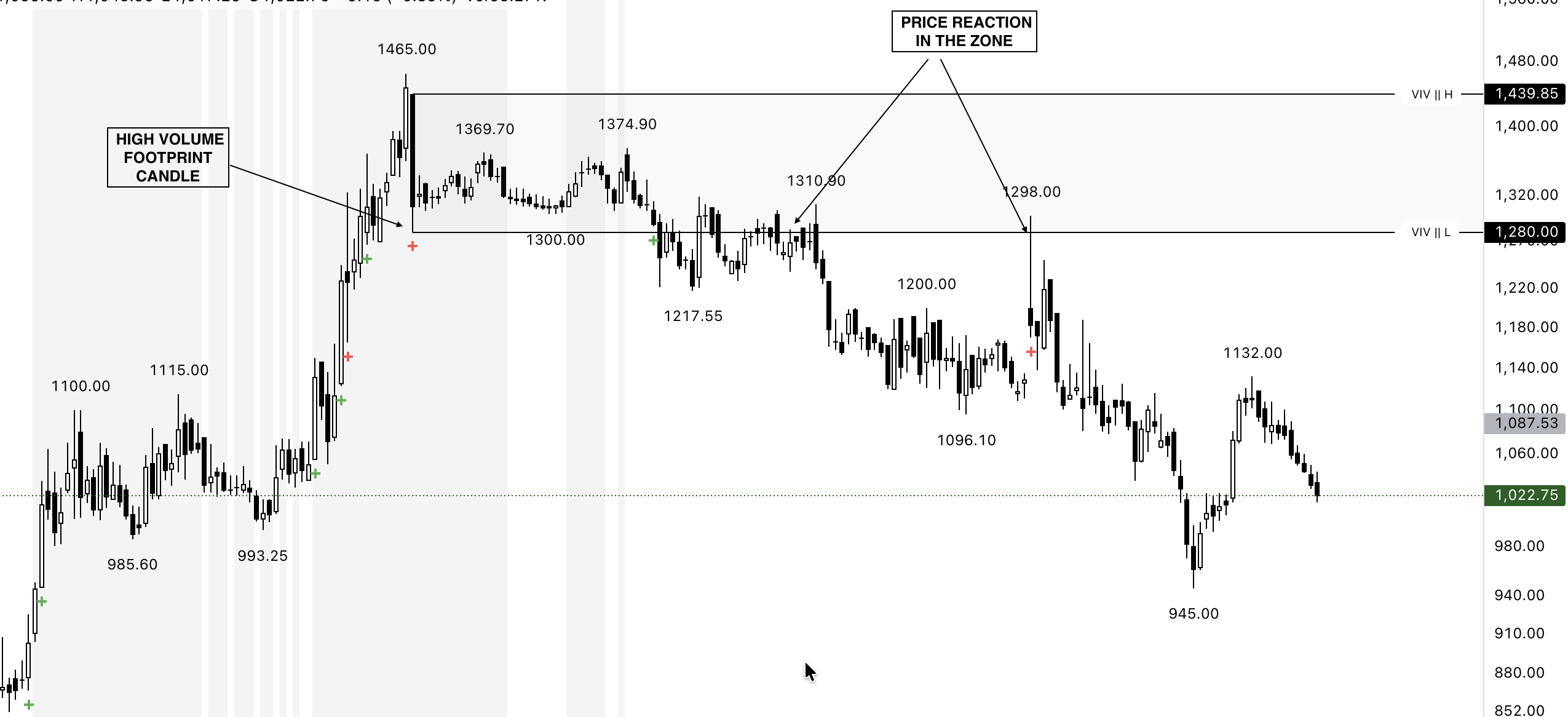

This is where VIV (Very Important Volume) comes in.

VIV tracks and highlights critical volume footprints that show where big players participated — and whether they’re defending those zones or abandoning them. Here’s how VIV helps you spot distribution in real time:

Distribution plays on human emotion:

Institutional distribution is not a sudden event — it’s a process.

Every top leaves clues: weakening follow-through, heavy volume without progress, and repeated rejection near highs. When you learn to recognize these footprints, you protect yourself from becoming liquidity for those exiting quietly. VIV simply gives those clues a voice — helping you see what’s happening behind the surface of price.

Before every major fall, someone always knew — now, that someone can be you.