There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Why You Keep Buying Late

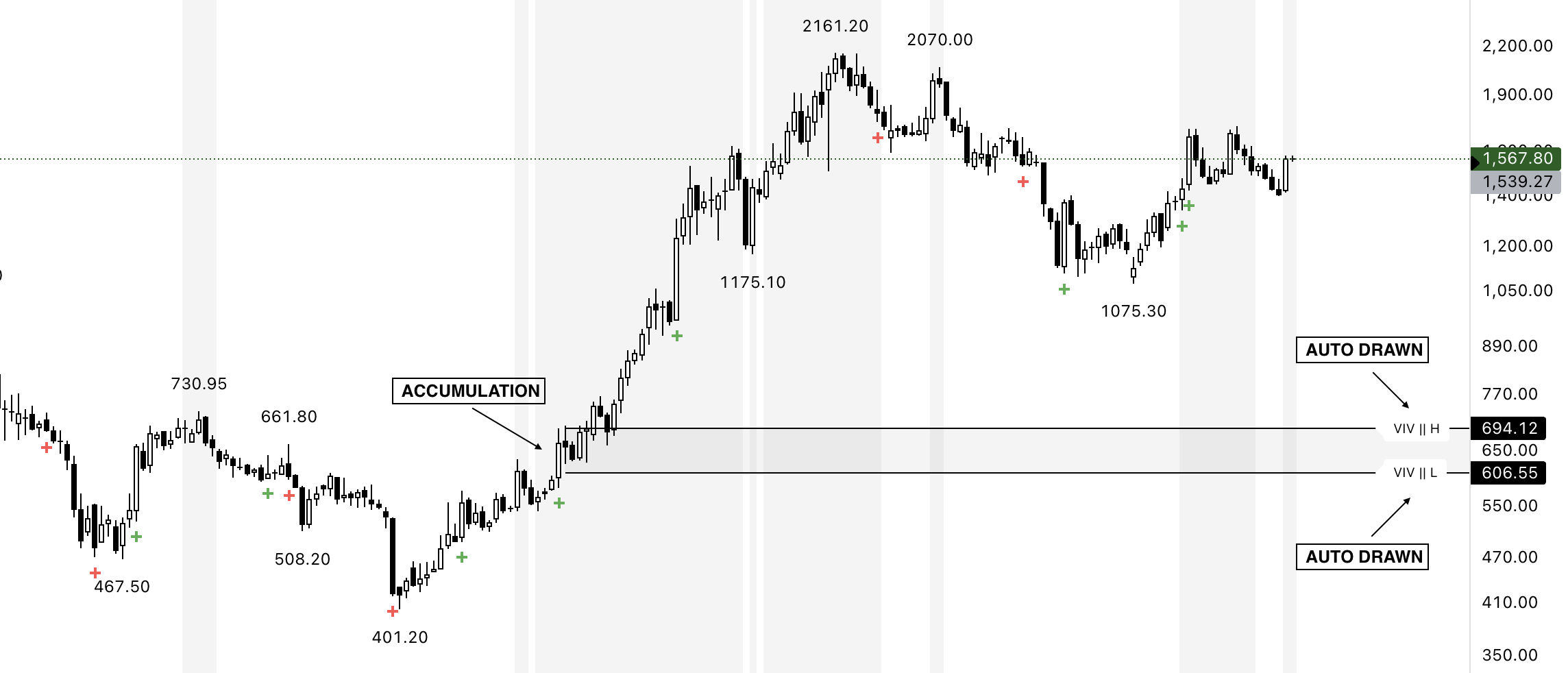

Ever wonder why price often takes off after you’ve given up on it? That’s because institutions quietly accumulate positions before the big move — while retail traders sit on the sidelines or get shaken out. These phases aren’t random. They’re deliberate, methodical, and visible to anyone who knows what to look for in price and volume. The good news: once you understand how to read accumulation footprints, you’ll stop chasing rallies and start entering before the crowd.

Accumulation is when large players — hedge funds, banks, prop desks — build positions without driving the market sharply higher. Their goal is to buy size quietly before launching a trend. Key characteristics:

Retail traders try to identify accumulation using patterns: flags, rectangles, Wyckoff phases. But these can be misleading.

Even without tools, you can spot accumulation using these filters:

Instead of manually scanning every chart and second-guessing volume, VIV (Very Important Volume) highlights these footprints for you.

Instead of manually scanning every chart and second-guessing volume, VIV (Very Important Volume) highlights these footprints for you.

Once you can see accumulation clearly — manually or using VIV — trading becomes simpler: