There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

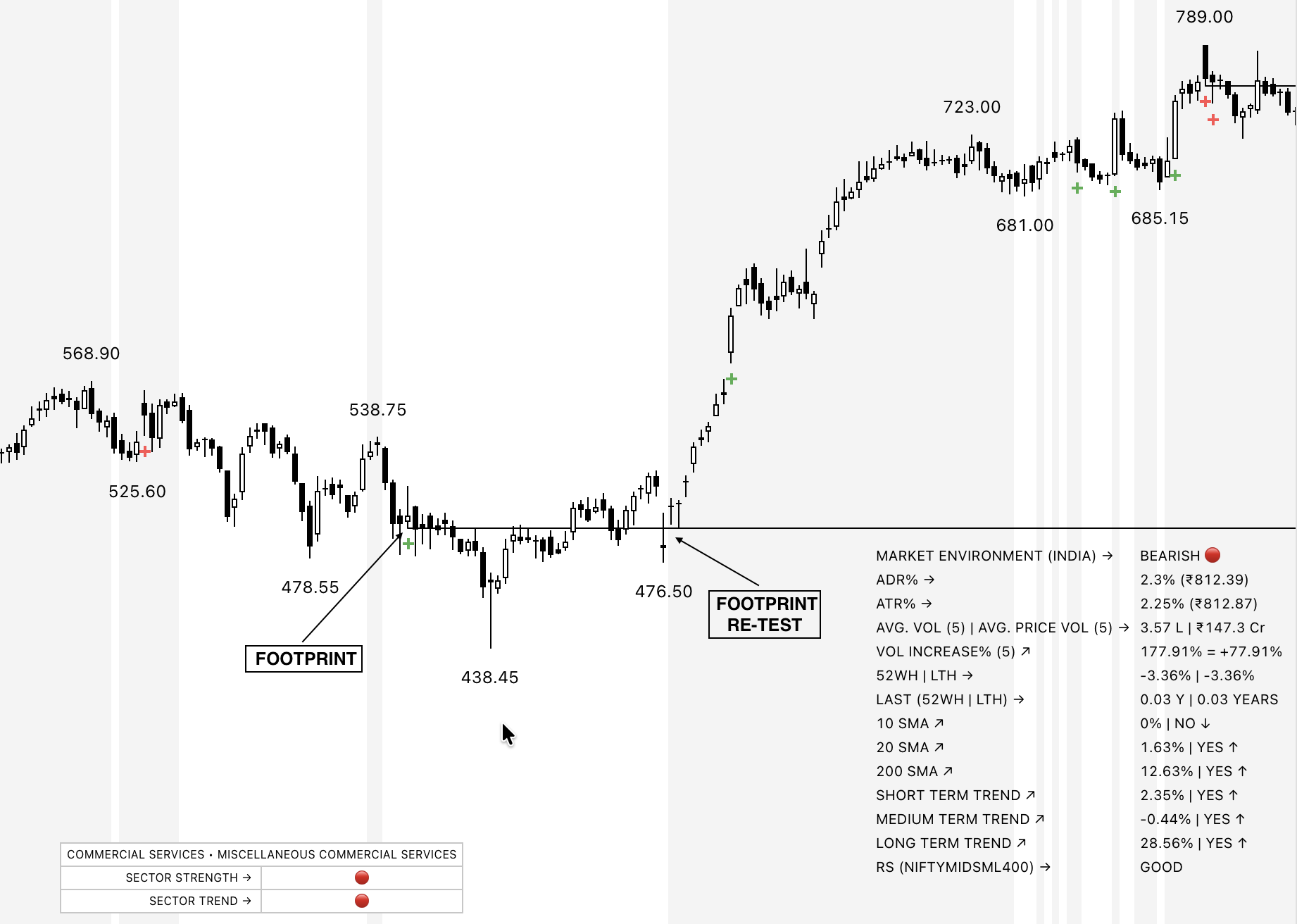

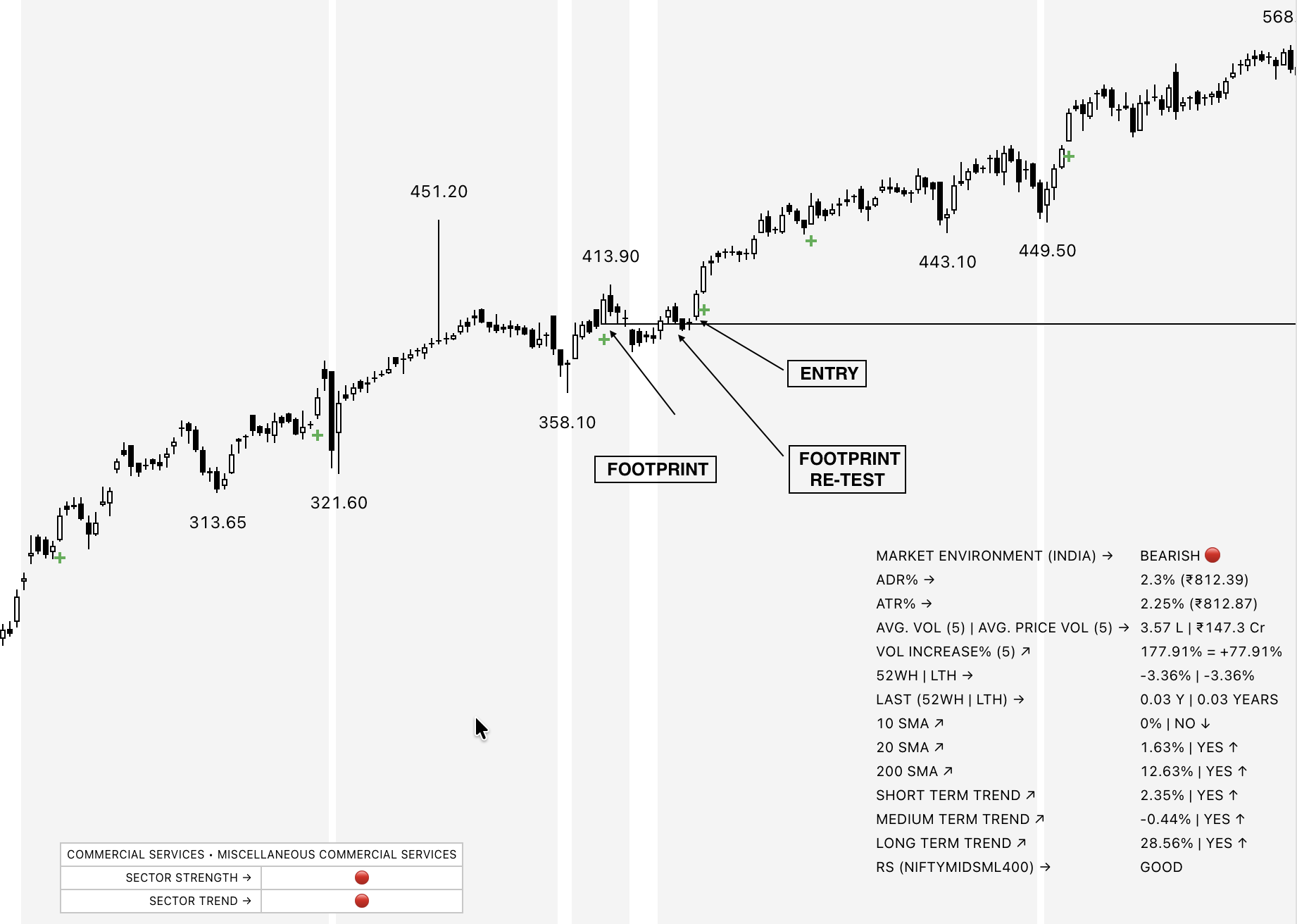

Every trader wants confidence — confidence that a breakout will hold, that a trend will continue, and that a level is worth trusting.

But confidence doesn’t come from indicators or opinions. It comes from clarity — and the clearest evidence in the market is whether institutions defend their critical volume zones during retests.

This is the essence of footprint retests.

Footprint retests tell you something no candle pattern can reveal:

Whether smart money is still in the game — or if they’ve quietly stepped aside.Most traders never see these retests because volume footprints are invisible on traditional charts. But with VIV, these footprints become visible… and retests become opportunities, not mysteries.

A footprint retest occurs when price returns to a high-volume institutional footprint zone after moving away from it. In simple terms:

Footprint retests are critical because they reveal real intention, not temporary noise. When price revisits a footprint:

Markets move in phases. After institutions enter, price rarely moves straight up. Instead, it comes back to test:

When institutions truly believe in a position, they don’t panic on pullbacks. They defend the zone by:

✔ Absorbing remaining selling pressure You’ll see higher volume but stable price.

✔ Rejecting price quickly Wicks form, showing demand stepping in.

✔ Preventing breakdown of key lows Even if price dips, it recovers immediately.

But when institutions are not interested:

✘ Footprint zones break easily Price slices through a previously strong level.

✘ Volume collapses Participation dries up — no one defending.

✘ Lower highs start forming Distribution begins.

This is how footprint retests reveal the true story of a trend.

Traditional charts don’t show:

Here’s the simplest framework:

1. Identify the footprint zone using VIV Look for high-volume bars highlighted by the indicator.

2. Wait for price to revisit the zone Retests always come — don’t chase breakouts.

3. Observe the reaction

A stock forms a high-volume candle at ₹1,200.

VIV marks this as a footprint zone.

Price rallies to ₹1,280, then pulls back to ₹1,200.

Now the key question:

Will smart money defend?

Footprint retests are one of the most reliable, honest forms of market confirmation. They reveal whether institutional conviction still exists — or whether it has quietly disappeared.

-Most traders see price.

-Very few see intention.

-VIV bridges that gap.

When you can read footprint retests with clarity: