There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

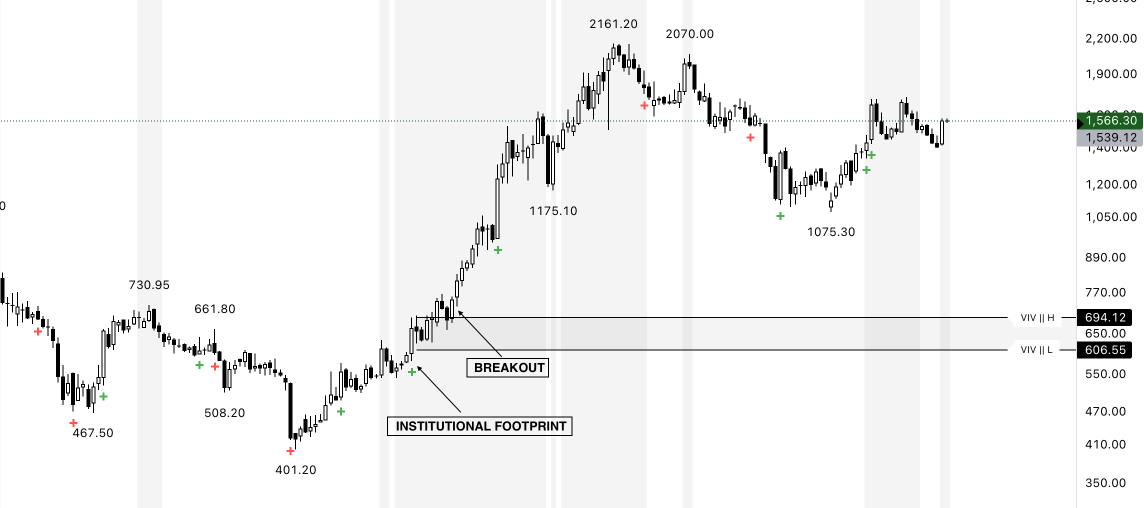

Not Every Breakout Is Real

Few things are more frustrating for a trader than watching price break above a key level… only to collapse minutes later. You entered thinking you’d caught a big move, but instead you bought the top. This is the world of fakeouts — false breakouts designed to trap retail traders. And here’s the truth: they’re not random. They’re engineered. Understanding the difference between a real breakout and a trap can protect you from losses — and even help you trade with the smart money instead of against it.

A real breakout occurs when price pushes through a key level with genuine participation. That means:

In short, when institutions are committed, price doesn’t hesitate.

A fakeout (false breakout) happens when price briefly pushes through a level without real conviction. Here’s how they often play out:

To avoid being trapped, watch for these warning signs:

If you’re trading without tools, here’s a quick checklist:

Doing all of the above manually is time-consuming. You need to check every breakout candle, compare volume levels, and constantly monitor multiple timeframes. One missed detail, and you’re caught in a fakeout. This is where VIV (Very Important Volume) simplifies the process:

Doing all of the above manually is time-consuming. You need to check every breakout candle, compare volume levels, and constantly monitor multiple timeframes. One missed detail, and you’re caught in a fakeout. This is where VIV (Very Important Volume) simplifies the process:

Here’s the advanced part: fakeouts can be traded — if you know what to look for.

Here’s the advanced part: fakeouts can be traded — if you know what to look for.

Stop Guessing, Start Reading the Story Breakouts and fakeouts aren’t random — they’re just a reflection of who’s in control. When you learn to read price and volume correctly, you stop chasing every move and start trading alongside the professionals. Whether you do this manually or let VIV handle the heavy lifting, the principle is the same:

Strong breakouts leave footprints. Weak ones leave traps. If you’ve ever felt like the market was “out to get you,” it’s probably because you were trading breakouts without confirmation. The good news? Once you see through the traps, the market starts to make a lot more sense.