There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

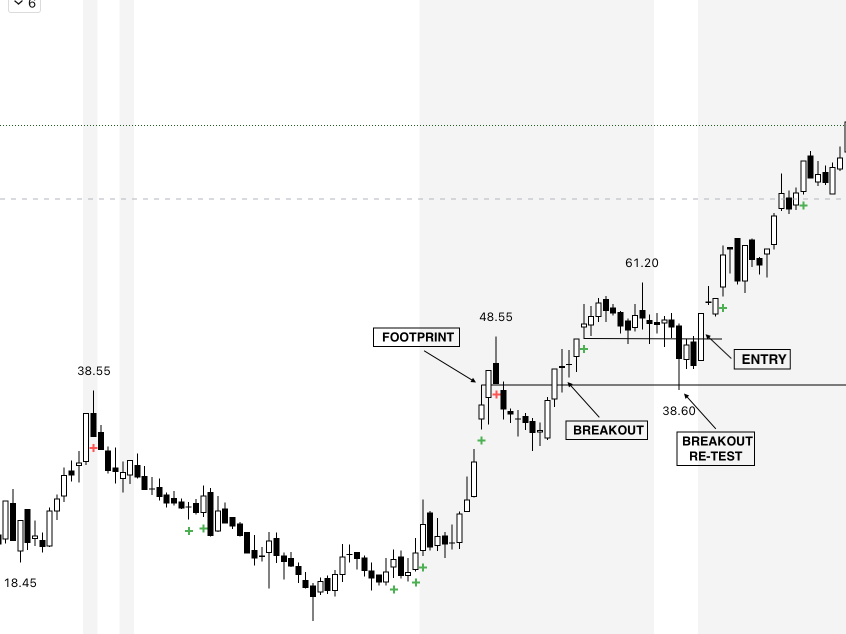

Every breakout looks exciting — price surges past resistance, traders jump in, and social media buzzes with breakout calls. But only a few of those breakouts sustain. Most fade quickly, trapping eager traders.

The difference between a fake breakout and a smart money breakout lies in one subtle but powerful clue — the retest. It’s the market’s way of confirming whether the breakout is genuine or just noise.

Understanding breakout retests is what separates professional traders from impulsive ones. Let’s decode how they work, how to spot them early, and why patience is the real edge in price action trading.

A breakout retest occurs when price breaks a key level (like resistance or support), then pulls back to test that same level before continuing in the direction of the breakout.

It’s the market’s way of saying:

“Let’s see if this level truly holds before we move further.”

Think of it as a handshake between buyers and sellers — confirmation that the previous barrier has now changed its role:

Old resistance → New support

Old support → New resistance

Retail traders chase the initial breakout candle. Smart money waits. Here’s why:

Markets are driven by human behavior: fear, greed, and regret.

Imagine a stock breaking below ₹500 (support).

Price falls to ₹475, then climbs back to ₹500 — only to reject it again and drop to ₹450. That ₹500 retest confirmed sellers regained control — a textbook bearish retest. The same logic applies to bullish setups when resistance turns into support.

Smart money doesn’t chase candles — they engineer liquidity.

They push price beyond resistance, trigger breakout traders, and then pull it back to absorb liquidity from trapped positions.

When the retest holds, they re-enter quietly — and that’s when the next leg begins. This is why many of the strongest moves come after a clean retest, not during the initial breakout hype.

The retest is not a delay — it’s the market’s final question before commitment.

When traders learn to wait for confirmation, they move from reacting to anticipating — from chasing to controlling.

Breakout retests are where smart money quietly positions for the next trend. By mastering this simple but powerful setup, you stop following the noise and start trading the rhythm of the market itself.

Patience isn’t just a trading skill — it’s the ultimate edge.